Legislation to implement the Government’s superannuation reforms passed the Parliament on 23 November 2016. The superannuation reform package was announced in the 2016-17 Budget and amended following consultation. The changes improve the fairness, sustainability, flexibility and integrity of the superannuation system.

At this stage, the Australian Taxation Office (ATO) is still consulting on the best approach to factor the superannuation reforms into the existing system. The contents of this page will be updated as soon as the ATO has provided clear guidelines.

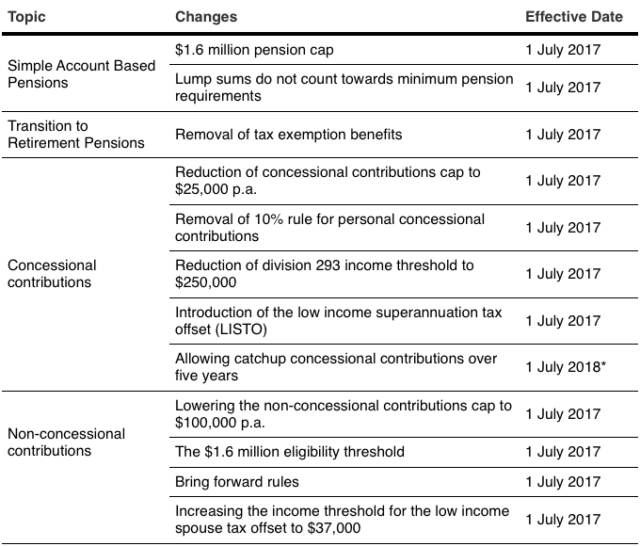

This package of reforms introduces significant changes affecting the following key areas:

- Simple Account Based Pensions

- Transition to Retirement Pensions

- Concessional contributions

- Non-concessional contributions

An overview of the Superannuation Reforms is detailed in the table below and a detailed explanation can be found in the relevant section that follows:

* The catch-up of concessional contributions is the only measure that will come into effect from 1 July 2018. All other changes will start to apply from 1 July 2017.

SIMPLE ACCOUNTS BASED PENSIONS

$1.6 Million Pension Cap

From 1 July 2017, the government will introduce a $1.6 million cap on the total amount that can be transferred into the tax-free retirement phase for simple account based pensions. This is known as the general transfer balance cap. The general transfer balance cap will be indexed in $100,000 increments in line with CPI.

Superannuation benefits accumulated in excess of the cap can remain in the accumulation account, where the earnings will be taxed at up to 15%.

Proportional Indexation

Where an individual has not used the full amount of the general transfer balance cap, their personal cap is subject to the proportional indexation. For example, if an individual has previously used up 75% of their cap they will have access to 25% of the current (indexed) cap.

Penalties for Excess Transfer Balance

Individuals who breach the cap will be required to remove the excess amount from the simple account based pension and will be liable to pay penalty tax on the notional earnings attributable to the excess capital. Notional earnings compound daily (based on general interest charges) until the breach is rectified or an excess transfer balance determination is issued by the ATO.

These amounts can be transferred back into an accumulation account, where the earnings on the excess will be taxed at up to 15%. Alternatively, the excess can be withdrawn from superannuation.

Transitional arrangements for individuals with existing pensions at 1 July 2017

There will be no penalty tax applied if the individual is in breach of the pension cap by less than $100,000 (i.e. total pension balance is less than $1.7 million) on 1 July 2017 and the breach is rectified within 6 months from 1 July 2017.

If the individual fails to rectify the small breach within 6 months or is in breach of the pension cap by more than $100,000 on 1 July 2017, the individual will be subject to the normal penalty arrangements as follows:

Normal Penalty Arrangements

For a first breach, individuals will be subject to a 15% penalty tax on the notional earnings. After the first breach, a higher penalty tax rate of 30% will apply to any subsequent breaches.

Transitional CGT Relief

Temporary CGT relief will be provided for accumulated capital gains on assets which would have been exempt but for the introduction of the $1.6 million pension cap. The trustee can elect to reset the asset’s cost base to its current market value. The relief will ensure that CGT is only payable (on the sale of these assets after 1 July 2017) on capital gains accrued from 1 July 2017.

The relief only applies to assets acquired by the Fund prior to 9 November 2016 and continued to be held by the Fund until 30 June 2017. The choice needs to be made in the approved form before the 2016/17 fund tax return is lodged, and cannot be revoked.

Lump Sums Do Not Count towards the Minimum Pension Requirements

Individuals will no longer be able to use partial commutations (i.e. lump sum withdrawals) to meet the minimum pension requirement after 1 July 2017. This implies that at least the minimum pension amount must be pension withdrawals and only the amount in excess of the minimum pension amount can be either lump sum withdrawals or pension withdrawals at the Trustee’s discretion.

If an individual is aged under 60 and retired, then 2016-17 is the last financial year during which the individual may choose to treat all withdrawals as lump sums and none as pensions in order to minimise tax in their personal tax return.

Other Types of Income Stream Products (e.g. Defined Benefit Pensions, Non-commutable Pensions etc.)

Different rules apply to other types of income stream products. Please contact your scheme provider directly in order to verify your personal circumstances.

The above information only provides a brief overview of the changes affecting Simple Account Based Pensions from 1 July 2017.

TRANSITION TO RETIREMENT PENSIONS

Removal of Tax Exemption Benefits

People who have reached preservation age but are under 65 and not retired can still access a Transition to Retirement Pension (TRAP).

However, from 1 July 2017 the Government will remove the tax exempt status of income from assets supporting Transition to Retirement Pensions regardless of the date the TRAP commenced. The earnings on the amount supporting TRAPs will be taxed at up to 15% (i.e. same tax rate applying to accumulation earnings).

The intent of this change is to ensure that TRAPs are not accessed primarily for tax minimisation purposes but for the purpose of supporting individuals who remain in the workforce with reduced working hours.

Transitional CGT Relief

Temporary CGT relief will be provided for accumulated capital gains on assets which would have been exempt but for the introduction of the TRAP earnings taxation measure. The trustee can elect to reset the asset’s cost base to its current market value. The relief will ensure that CGT is only payable (on the sale of these assets after 1 July 2017) on capital gains accrued from 1 July 2017.

The relief only applies to assets acquired by the Fund prior to 9 November 2016 and continued to be held by the Fund until 30 June 2017. The choice needs to be made in the approved form before the 2016/17 fund tax return is lodged, and cannot be revoked.

Commuting the TRAP on 30 June 2017

If you do not need to access your super benefits to supplement your personal expenses, you may choose to commute (i.e. cease) the TRAP on 30 June 2017.

The above information only provides a brief overview of the changes affecting Transition to Retirement Pensions from 1 July 2017.

CONCESSIONAL CONTRIBUTIONS

Reduction of Concessional Contributions Cap to $25,000 p.a.

Currently, individuals can make concessional (pre-tax) contributions up to $30,000 for those aged under 49 at 30 June of the previous financial year and $35,000 otherwise.

From 1 July 2017, the Government will lower the annual concessional contributions cap to $25,000 for all individuals aged under 75. The cap will be indexed in $2,500 increments (instead of the current $5,000 increase) in line with wages growth.

Allowing Personal Concessional Contributions Regardless of Employment Situations

Currently, individual are only allowed to claim a tax deduction in the personal tax return for personal contributions if they meet the 10% rule (i.e. employment income divided by your assessable income is less than 10%).

From 1 July 2017, all individuals aged under 75 are allowed to make concessional superannuation contributions up to the concessional cap (including those aged 65 to 74 who meet the work test) regardless of their employment situations.

This change will benefit individuals who are partly self-employed and partly salary earners, and individuals whose employers do not offer salary sacrifice.

Reduction of Division 293 Income Threshold from $300,000 to $250,000

Currently individuals with income and concessional super contributions in excess of $300,000 are required to pay 30% tax on their concessional superannuation contributions – commonly referred to as the Division 293 threshold.

From 1 July 2017, the government will reduce the income threshold, above which individuals will be required to pay an additional 15% tax on their concessional contributions, from $300,000 to $250,000 per annum.

The additional tax is imposed on the whole amount of the contributions, up to the concessional contributions cap, if your salary and wages are above the threshold. Otherwise, the additional tax is only imposed on the portion of the contribution that takes you over the threshold.

The intent of this change is to better target tax concessions to ensure the superannuation system is equitable and sustainable.

Introduction of the Low Income Superannuation Tax Offset (LISTO)

The government will introduce a Low Income Superannuation Tax Offset (LISTO), which will replace the Low Income Superannuation Contribution (LISC) policy that has been repealed from 1 July 2017.

From 1 July 2017, eligible individuals with an adjusted taxable income up to $37,000 will receive a LISTO contribution equal to 15% of their total concessional (pre-tax) super contributions for an income year, capped at $500.

The Australian Taxation Office will determine a person’s eligibility for the Low Income Superannuation Tax Offset and this will be paid into the person’s superannuation account.

Allowing Catchup Concessional Contributions over Five Years

From 1 July 2018, individuals will be able to make ‘carry-forward’ concessional super contributions if they have a total superannuation balance of less than $500,000 at 30 June of the previous financial year. Individuals aged 65 to 74 also need to meet the work test in order to access these arrangements.

Eligible individuals will be able to access their unused concessional contributions cap space on a rolling basis for five years. Amounts carried forward that have not been used after five years will expire.

Only unused amounts accrued from 1 July 2018 can be carried forward. This means the first year in which you can access unused concessional contributions is the 2019-20 financial year.

This increased flexibility will make it easier for people with varying capacity to save and for those with interrupted work patterns, to save for retirement and benefit from the tax concessions to the same extent as those with regular income.

NON-CONCESSIONAL CONTRIBUTIONS

Lowering the Non-Concessional Contributions Cap to $100,000 p.a.

From 1 July 2017, the Government will reduce the annual non-concessional (after tax) contribution cap from $180,000 to $100,000 per year, which is four times the annual concessional contributions cap. The cap will be indexed in line with the concessional contributions caps.

The $1.6 million Eligibility Threshold

In addition, the Government will introduce a new constraint such that individuals with a total superannuation balance of $1.6 million or more at 30 June of the previous financial year will no longer be eligible to make non-concessional contributions.

Bring Forward Rules

The above two changes will affect the individual’s ability to bring forward non-concessional contributions.

Aged under 65 on 1 July

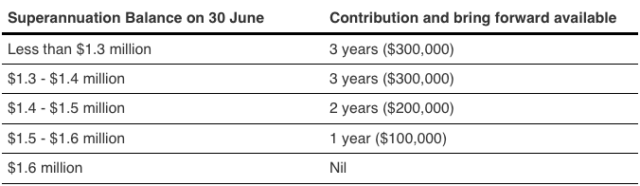

If an individual is under 65 years old, there is capacity to bring forward one or two years of non-concessional contributions (i.e. $200,000 cap over two years or $300,000 cap over three years) depending on the individual’s total superannuation balance on 30 June of the previous financial year.

Individuals with balances close to $1.6 million will only be able to bring forward the annual cap amount for the number of years that would take their balance to $1.6 million.

The following table sets out the bring forward cap and bring forward period depending on the individual’s total superannuation balance on 30 June of the previous financial year:

Aged between 65 ~ 74

The bring-forward is not available to individuals between 65 and 74 years old. These individuals can contribute non-concessional contributions up to $100,000 per annum provided they meet the work test and their total superannuation balances at 30 June of the previous financial year are $1.6 million or less.

Transitional Rules

Where an individual has triggered the bring forward in 2015-16 or 2016-17 but has not used it fully by 30 June 2017, transitional rules will apply. The remaining bring forward cap will be re-assessed on 1 July 2017 to reflect the new contributions cap.

If an individual triggers the bring forward in 2015-16, the transitional cap is $460,000 (the current caps of $180,000 in 2015-16 and 2016-17 plus $100,000 annual cap in 2017-18).

If an individual triggers the bring forward in 2016-17, the transitional cap is $380,000 (the current cap of $180,000 plus $100,000 annual caps in 2017-18 and 2018-19).

The above information only provides a brief overview of the changes affecting Non-concessional contributions from 1 July 2017.

Extending the Spouse Tax Offset

The Government will extend the current spouse tax offset to assist more couples to support each other in saving for retirement.

From 1 July 2017, the income threshold for the low income spouse tax offset will be increased from $10,800 to $37,000. As is currently the case, the offset is gradually reduced for income above this level and completely phases out at income above $40,000.

No tax offset will be available when the spouse receiving the contribution has exceeded their non-concessional contributions cap or their balance at 30 June of the previous financial year is $1.6 million or more.

There are no changes to the current aged based contribution rules. The spouse receiving the contribution must be under age 70, and meet a work test if aged 65 to 69.

SEEK ADVICE BEFORE 1 JULY 2017

This package of Superannuation Reforms involves complex changes which may affect your retirement plans. The situation is even more complex if you have superannuation benefits in multiple Superfunds. This is because all the thresholds and caps apply to your total superannuation balance, not your balance in each individual Superfund.

Seek Professional Advice from a Financial Adviser

Ken Mangraviti Pty Ltd is NOT a licensed financial adviser and does not provide financial advice to clients. We recommend that you seek professional advice from a financial adviser. A licensed financial adviser will consider your personal situation and make a recommendation suitable to your particular financial needs.

It should always be remembered that Trustees are legally responsible for all the decisions made even if you obtain advice from a Financial Planner. Whilst a Financial Professional can provide advice and assistance you are ultimately responsible for the Fund.